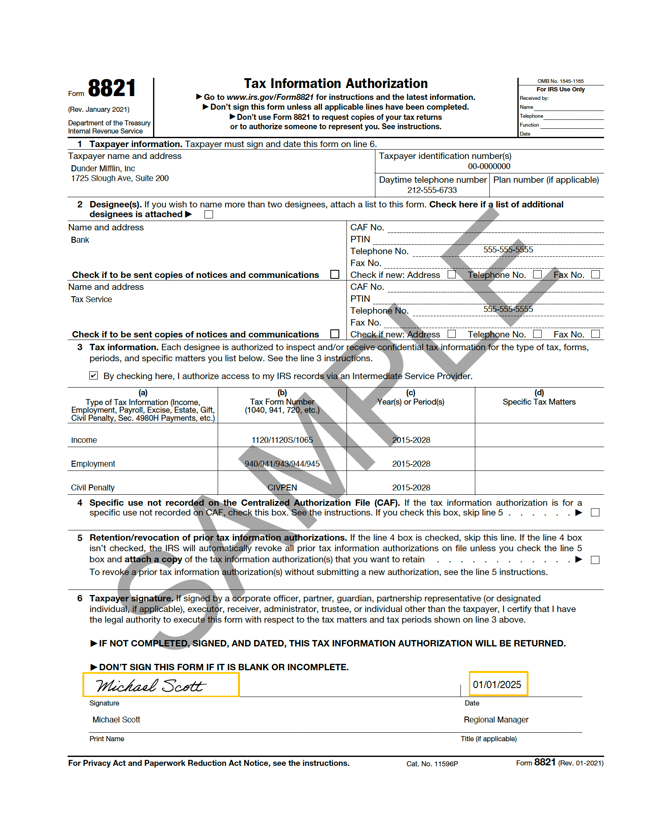

Form 8821 - Business

What Form 8821 is, why the SBA needs it, and how to complete it quickly—with no stress about what it gives access to.

WHY

The SBA needs to verify that the tax returns you submitted match what the IRS has on file.

Form 8821 gives the bank permission to pull official tax transcripts for your business—but it does not give them access to your full tax return or allow them to make changes. It's read-only, and only used to confirm accuracy.

When you apply for an SBA loan, the bank is required to confirm: You have no tax liability, even if it’s just $1.

If there is a tax liability, there’s a payment plan in place with at least 3 months of on-time payments documented.

WHAT

IRS Form 8821 is a short authorization form that:

-

Lets the bank request your business’s tax transcript directly from the IRS

-

Does not allow them to change anything or act on your behalf

-

Is required for SBA loans as part of fraud prevention and eligibility review

HOW

-

The bank will send you the form completely filled out minus your signature and date.

-

You’ll sign and date it—sometimes the bank will request "wet ink". "Wet ink" means you must print, sign, scan. This allows for faster processing time.

-

Return the signed form to us or upload to your document portal.

📣 Pro Tips:

-

Use a blue or black pen and sign clearly—fuzzy scans get rejected.

-

Double-check that the business name and EIN match your tax return.

-

If your business filed under a different name (e.g. old LLC), let us know before submitting.

FAQ – IRS Form 8821 (Business)

Q: What does this form actually allow the bank to see?

A: Just your tax transcript—a summary of what was filed with the IRS. Not the full return, and they can't change anything.

Q: Is this the same as giving tax power of attorney?

A: No. That would be Form 2848. The 8821 is view-only access, nothing else.

Q: Why do I need this if I already uploaded my tax returns?

A: This lets the bank verify what they received matches IRS records. It’s part of SBA compliance rules to prevent fraud.

Q: Can I e-sign it?

A: Some lenders require a wet signature. If so, just print, sign, and snap a photo—we’ll handle the rest.